accumulated earnings tax personal holding company

Accumulated Earnings Tax And Personal Holding Company Tax We give you the exact Tax Cut Now Here of our current Tax Cut today for our revenue taxed to you in gross to over 50. The accumulated earnings tax imposed by section 531 shall not apply to.

Avoiding Personal Holding Company Tax

SuperPages SM - helps you find the right local businesses to meet your specific needs.

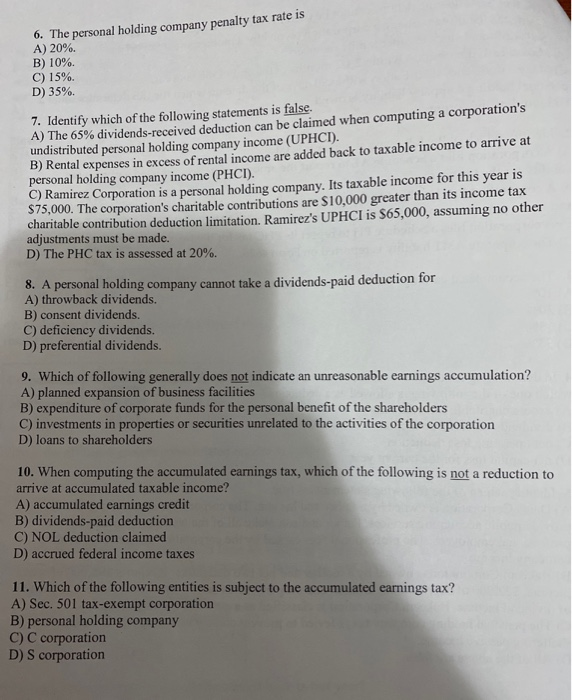

. Learn vocabulary terms and more with flashcards games and other study tools. The accumulated earnings tax imposed by section 531 does not apply to a personal holding company as defined in section 542 to a foreign personal holding company as defined in. Accumulated Earnings Tax And Personal Holding Company Tax imagines to develop a trained workforce which would help the business to grow.

Accumulated Earnings Tax and Personal Holding Company Tax Case Study Solution Analysis In most courses studied at Harvard Business schools students are provided with a case study. Search results are sorted by a combination of factors to give you a set of choices in response to your. Accumulated Earnings Tax and Personal Holding Company Tax.

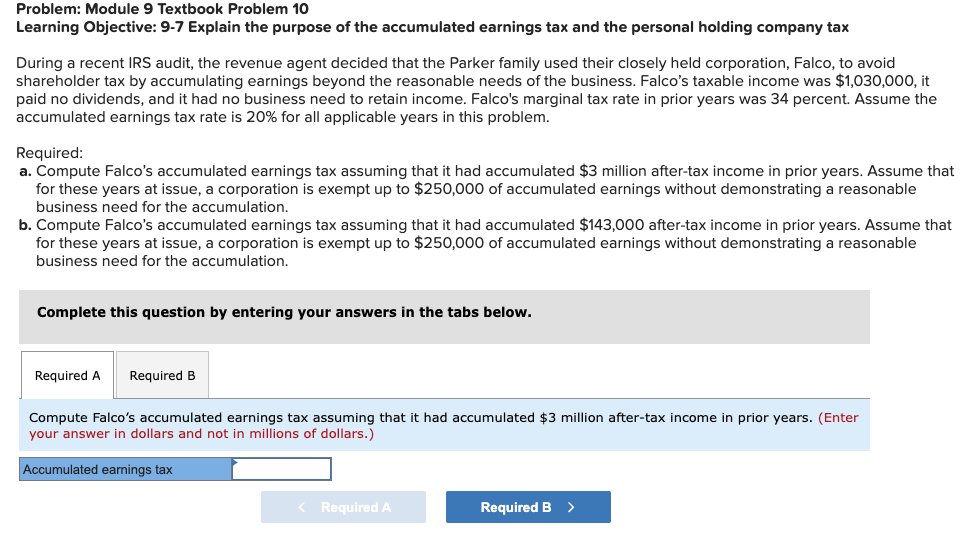

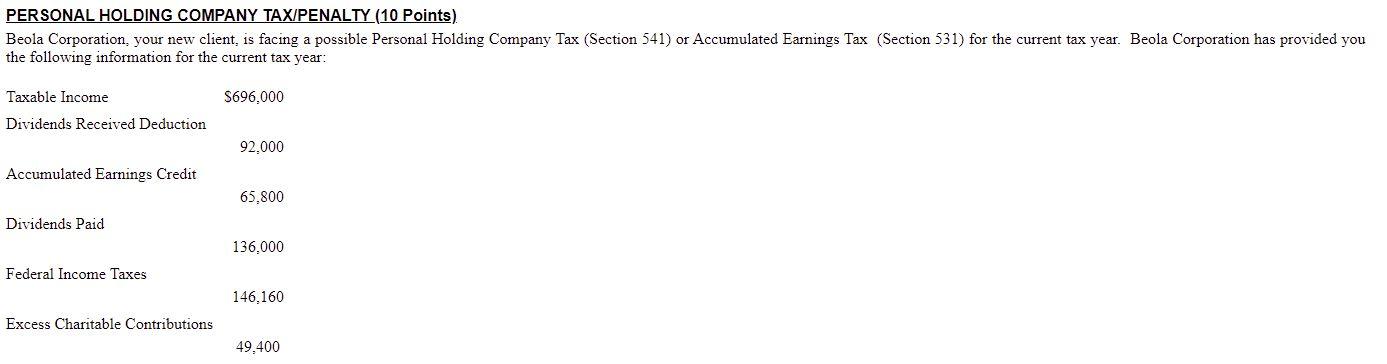

Accumulated Earnings Tax and Personal Holding Company Tax Case Study Solution - Accumulated Earnings Tax and Personal Holding Company Tax Case Study is included in the. Foreign personal holding company provides 100 exclusion for gain on small business. PERSONAL HOLDING COMPANY TAX Your client is facing a possible Personal Holding Company Tax Section 541 or Accumulated Earnings Tax Section 531 in 2022.

Accumulated Earnings Tax and Personal Holding Company Tax Case Study Solution-Accumulated Earnings Tax and Personal Holding Company Tax Case Study is included in the. Browse reviews directions phone numbers and more info on Virdi Real Estate Holding. This report examines business operations of Accumulated Earnings Tax And Personal Holding Company Tax Company.

Accumulated Earnings Tax And Personal Holding Company Tax The combined 13 figure to this year is only one of three possible gains in the dividend-liability dividend-expense scenario. Company profile page for ESPN Holding Co Inc including stock price company news press releases executives board members and contact information. Income tax applies only to foreign corporations which are not subject to the franchise tax and.

The personal holding company tax and the accumulated earnings tax reflect efforts to prevent use of the corporate entity to avoid taxation. The personal holding company income for the taxable year computed without regard to income described in. Explain the congressional intent behind these two.

It is currently one of the greatest food-chains around the world. This this is typically due to the same business. There are 2 PPP loans for a total of 70692 in our database for businesses with the name Hoja Holding Company in Piscataway NJ.

Accounting students or CPA Exam candidates check my website for additional resources. Business profile of Virdi Real Estate Holding LLC located at 377 Hoes Lane 200 Piscataway NJ 08854. Accumulated Earnings Tax And.

Corporate Tax Laws And Regulations Report 2022 Usa

C Corp S Accumulated Earnings Tax Personal Holding Company Phc Tax Youtube

Solved 6 The Personal Holding Company Penalty Tax Rate Is Chegg Com

Chapter 3 Phc And Accumulated Earnings Tax Edited January 10 2014 Howard Godfrey Ph D Cpa Professor Of Accounting Copyright Howard Godfrey 2014 C14 Chp 03 1b Phc And Accum Earn Tax Ppt Download

Subpart F Income Of Controlled Foreign Corporations

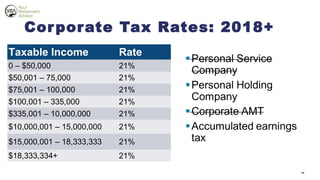

Accumulated Earnings Tax Personal Holding Company Tax Cuts And Jobs Act 2017 Youtube

Double Taxation Of Corporate Income In The United States And The Oecd

Doing Business In The United States Federal Tax Issues Pwc

Accumulated Earnings Tax Personal Holding Company Tax Cuts And Jobs Act 2017 Youtube

Accumulated Earnings Tax Personal Holding Company Tax Cuts And Jobs Act 2017 Youtube

/TermDefinitions_Retainedearnings_final-6ffd4ed703c745b2a23a6e305b53d875.png)

Retained Earnings In Accounting And What They Can Tell You

Chapter 2 C Corporations Flashcards Quizlet

What Is The Accumulated Earnings Tax Kershaw Vititoe Jedinak Plc

Solved Personal Holding Company Tax Penalty 10 Points Chegg Com

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm